|

| New lows in soybeans, as we again break below $12 and this time take out the previous lows. Down -43 cents the past two days.

Corn and wheat held in there but corn had an outside down day which is typically a negative indicator as we took out yesterdays highs and closed below yesterdays lows.

Disappointing week following what looked to be potential reversals earlier in the week as from a technical standpoint we made key reversals. Corn and wheat are both still holding their key reversals from earlier thus far despite the lower action today.

The grains were actually stronger overnight, however they went under immediate pressure following the release of the non-farm payroll numbers this morning. This led to a surge in the US dollar. With our export demand already being weak, the rally in the dollar didn’t help things.

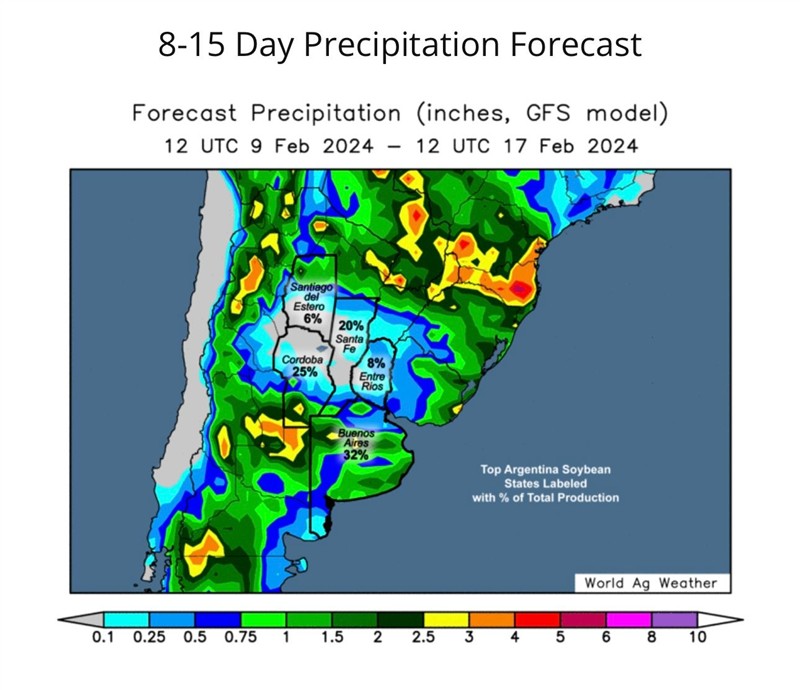

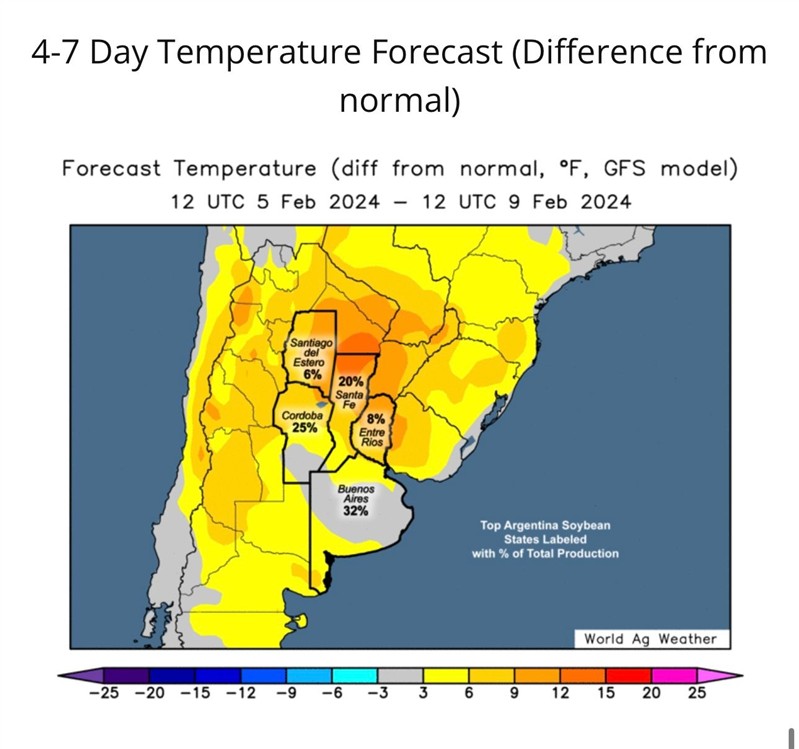

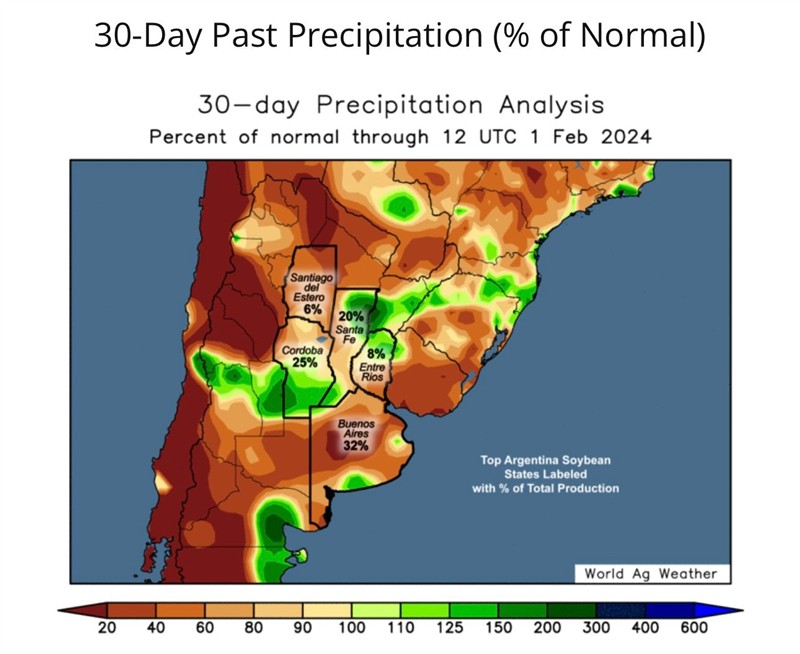

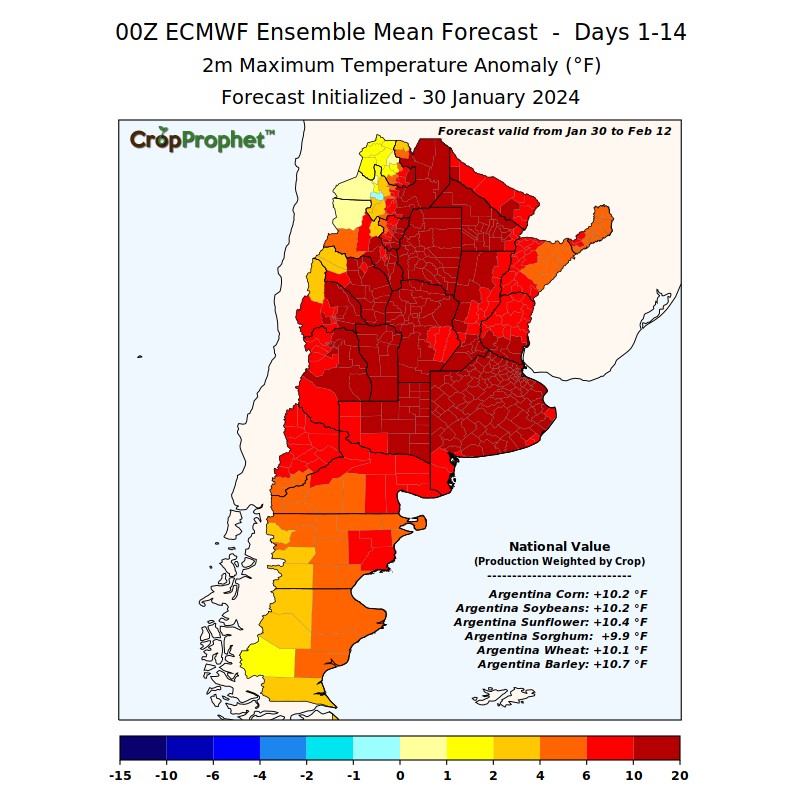

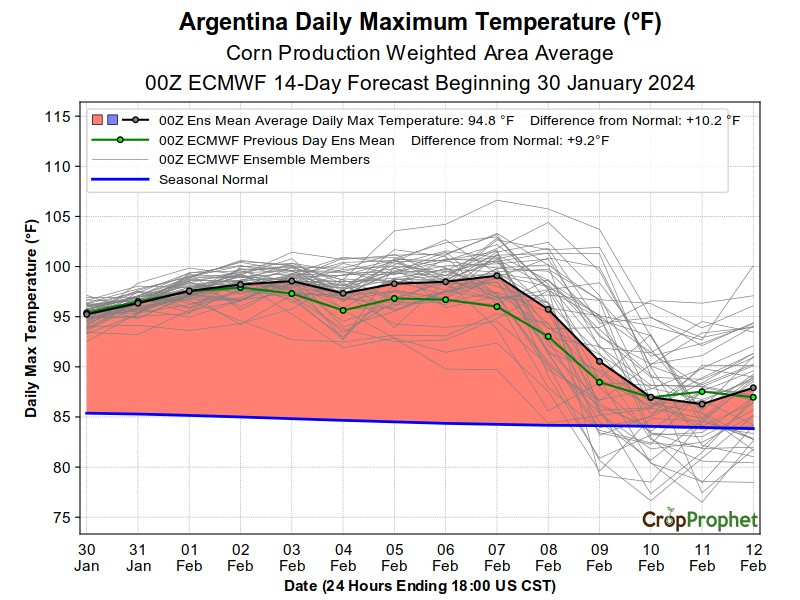

Then we have Argentina. They are looking hot and dry through early next week, but are expected to get rains late next week. If they do not get these rains, we will probably see another decline to the Argentina crop conditions.

The past week alone we saw their good to excellent crop ratings drop -6% in soybeans and -5% in corn. Their crop is still obviously in better shape than last year, but the bears main argument has been that Argentina is supposed to make up for the losses in Brazil.

Gro Intelligence says their forecast models show corn yields in Argentina have dropped more than -10% and soybeans have dropped -8%... since mid-January.

Despite the recent drought concerns, we actually saw USDA attache to Argentina RAISE their corn production estimates to 57 million metric tons. Which is 2 million higher than the USDA has…

Read the rest of today’s update where we go over how low we think corn can get, the industry’s thoughts on Argy, managing your risk & more

Read Here: https://txt.so/FUEpqg

Below are some charts & forecasts.

Corn bulls desperately need to break that downtrend from July.

Beans next stop could very well be $11.75 if we don’t bounce here. If we can’t hold there.. there is still a big pocket of air to the downside to our summer lows of $11.45. Bulls are hoping these upcoming Argy rains miss.

(Screen Shot 2024-02-02 at 3.02.05 PM (full).jpg) (Screen Shot 2024-02-02 at 3.02.05 PM (full).jpg)

(Screen Shot 2024-02-02 at 3.02.16 PM (full).jpg) (Screen Shot 2024-02-02 at 3.02.16 PM (full).jpg)

(IMG_0447 (full).jpg) (IMG_0447 (full).jpg)

(IMG_0448 (full).jpg) (IMG_0448 (full).jpg)

(IMG_0449 (full).jpg) (IMG_0449 (full).jpg)

(IMG_0446 2 (full).jpg) (IMG_0446 2 (full).jpg)

(IMG_0444 (full).PNG) (IMG_0444 (full).PNG)

(IMG_0445 (full).PNG) (IMG_0445 (full).PNG)

Attachments

----------------

Screen Shot 2024-02-02 at 3.02.05 PM (full).jpg (62KB - 117 downloads) Screen Shot 2024-02-02 at 3.02.05 PM (full).jpg (62KB - 117 downloads)

Screen Shot 2024-02-02 at 3.02.16 PM (full).jpg (71KB - 112 downloads) Screen Shot 2024-02-02 at 3.02.16 PM (full).jpg (71KB - 112 downloads)

IMG_0447 (full).jpg (105KB - 123 downloads) IMG_0447 (full).jpg (105KB - 123 downloads)

IMG_0448 (full).jpg (89KB - 128 downloads) IMG_0448 (full).jpg (89KB - 128 downloads)

IMG_0449 (full).jpg (94KB - 122 downloads) IMG_0449 (full).jpg (94KB - 122 downloads)

IMG_0446 2 (full).jpg (91KB - 128 downloads) IMG_0446 2 (full).jpg (91KB - 128 downloads)

IMG_0444 (full).PNG (128KB - 186 downloads) IMG_0444 (full).PNG (128KB - 186 downloads)

IMG_0445 (full).PNG (135KB - 196 downloads) IMG_0445 (full).PNG (135KB - 196 downloads)

| |

|

Market Comments - New Bean Low & Argy Ratings Dropping

Market Comments - New Bean Low & Argy Ratings Dropping