Not a subscriber to the WSJ, but if you want a breakdown of costs in the Bakken, then this is a little snippet from a report on the Bakken costs and production.

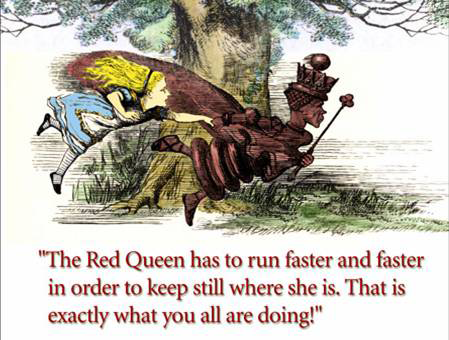

The eight in this series is a post by Rune Likvern on shale oil production in the US Bakken basin. In this post I present the results from an in-depth time series analysis from wells producing crude oil (and small volumes of natural gas) from the Bakken - Bakken, Sanish, Three Forks and Bakken/Three Forks Pools - formation in North Dakota. The analysis uses actual production data from the North Dakota Industrial Commission as of July 2012 from what was found to be a representative selection of wells from operating companies and areas. The reference in the title to the Red Queen from “Through the Looking-Glass” by the English author Charles Lutwidge Dodgson (perhaps better known as his pseudonym Lewis Carroll) who was also a mathematician and logician, is deliberate to create associations with the Red Queen’s statement "It takes all the running you can do, to keep in the same place". After presenting, discussing and concluding the results from the study presented in this post, the reference to the Red Queen was found to be an apt analogy to describe why technology and/or price cannot overcome the inevitable fact that field size and well productivity declines in most plays, whether in shale or any other plays. Put in a different way: shale plays do not get a pass on the laws of physics or the history of play and basin developments.The potential and technology for extraction (production) of shale/tight oil has been around for several decades. There is every reason to embrace the recent additions of shale oil (from Bakken, Eagle Ford and other plays). These additions will help ease the present tight global oil supply situation and thus slow down the growth in oil prices.

Figure 01: The illustration above is from “Through the Looking-Glass”. At the top of the hill, the Red Queen begins to run, faster and faster. Alice runs after the Red Queen, but is further perplexed to find that neither one seems to be moving. When they stop running, they are in exactly the same place. Alice remarks on this, to which the Red Queen responds: "Now, here, you see, it takes all the running you can do to keep in the same place". Continued below the fold.

MAJOR FINDINGS FROM THE STUDYAll charts in this post are clickable for a larger version. Findings from this in-depth study of time series for production from some individual wells: - Presently the estimated breakeven price for the “average” well in the Bakken formation in North Dakota is $80 - $90/Bbl In plain language this means that presently the commercial profitability for new wells is barely positive.

- The “average” well now yields around 85 000 Bbls during the first 12 months of production and then experiences a year over year decline of 40% (+/-) 2%

- The recent trend for newer “average” wells is one of a perceptible decline in well productivity (lower yields)

- As of 2007 and also as of recent months, the total production of shale oil from Bakken, has shown exceptional growth and the (relatively high) specific average productivity (expressed as Bbls/day/well) has been sustained by starting up flow from an accelerating number of new wells

- Now and based upon present observed trends for principally well productivity and crude oil futures (WTI), it is challenging to find support for the idea that total production of shale oil from the Bakken formation will move much above present levels of 0.6 - 0.7 Mb/d on an annual basis.

Authoritative research companies (like Bernstein Research) and widely acknowledged specialists/institutions like USGS and SPE have recently and in general arrived at identical conclusions by applying different sets of methodologies and from studying other areas.I am of course in no position to rule out that the required breakeven price in the future could be lowered driven by technological innovations and improvements in well design and operations. However recently there have been a flow of reports that casts a reasonable doubt that this will become a given. |

I continue to drink Sat's beary flavored kool-aid Part 2

I continue to drink Sat's beary flavored kool-aid Part 2