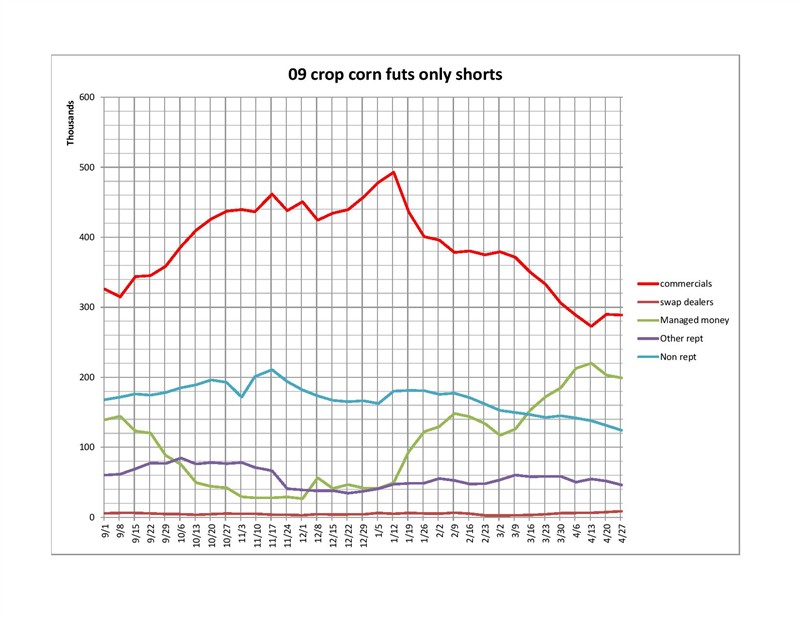

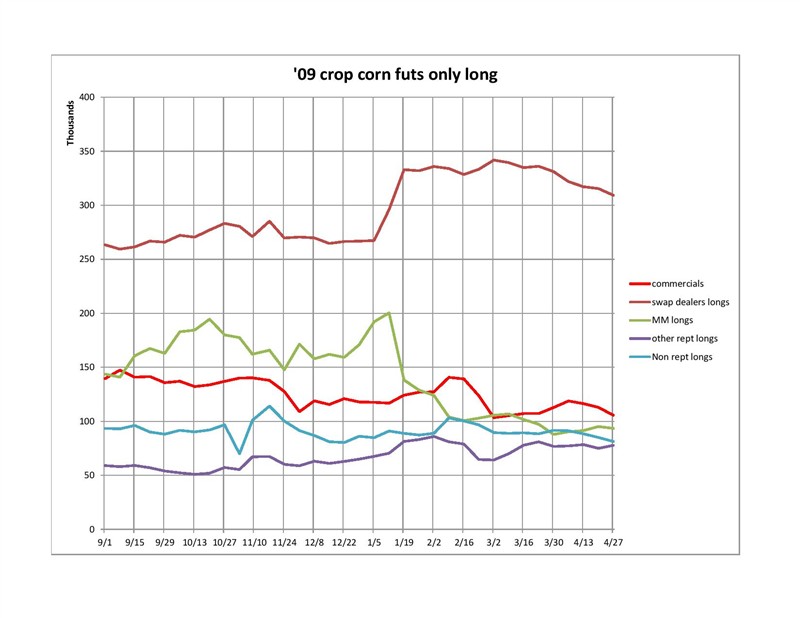

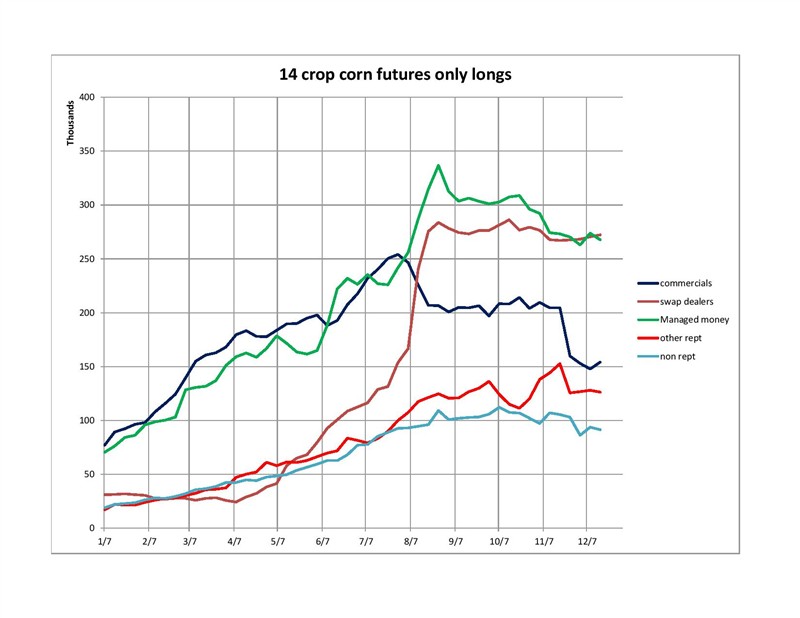

Death comes to us all. Life's but a walking shadow | There was a good deal to consider and digest in the 09/14 corn price comparison thread below and I have only just started on it. Sat pointed out the very different futures positions of the various participants between 09 and now. I think it is worth looking at this a little closer. Below are my updated '14 corn crop charts as well as the 09 corn crop charts covering the harvest period and extending into spring. I could go nuts looking at all the various permutations available but let's not and besides I'm not that ambitious. When comparing the two periods it is important to keep track of the time scale on each chart. It can be a little confusing.

I think the message is: The situation in 2009 and 2010 was very different than today. We were in the middle of a very serious recession. I'm not sure we can compare the various positions then and now. There are many difference almost too numerous to list out.

For instance in the fall of 2009 swap dealers had limited positions in corn futures but came back into the market strongly later. Remember the swap dealer (aka derivatives traders) were the ones who caused all the fracas in the first place. To the extent that they were coming back into the corn futures market just now supports Sat's contention that they were responsible for the rally in price we see there in late 2009. The difference this year is that swap dealers and managed money came into the market back in August even while prices continued to decline. In other words their presence didn't really affect the price. The problem is, look at the behavior of the managed money's short position starting in Jan 10. Earlier in 09 they were short then went more long during the fall and then very strongly short starting in Jan'10 just when the price collapsed.

Meanwhile look at the commercial short hedgers in '09 and '10. They developed substantial but not as substantial short positions earlier in 09 but liquidated them in Jan, Feb etc. Will they do that again this year?

Edited by 1234 12/21/2014 06:45

(09 crop corn futs only shorts-page-001.jpg) (09 crop corn futs only shorts-page-001.jpg)

(14 corn futs only shorts-page-001 (1).jpg) (14 corn futs only shorts-page-001 (1).jpg)

(09 crop corn futs only long-page-001.jpg) (09 crop corn futs only long-page-001.jpg)

(14 corn futs only long-page-001 (2).jpg) (14 corn futs only long-page-001 (2).jpg)

Attachments

----------------

09 crop corn futs only shorts-page-001.jpg (94KB - 736 downloads) 09 crop corn futs only shorts-page-001.jpg (94KB - 736 downloads)

14 corn futs only shorts-page-001 (1).jpg (82KB - 710 downloads) 14 corn futs only shorts-page-001 (1).jpg (82KB - 710 downloads)

09 crop corn futs only long-page-001.jpg (67KB - 700 downloads) 09 crop corn futs only long-page-001.jpg (67KB - 700 downloads)

14 corn futs only long-page-001 (2).jpg (63KB - 695 downloads) 14 corn futs only long-page-001 (2).jpg (63KB - 695 downloads)

|

'09/ 14 corn price comparisons (cont.)

'09/ 14 corn price comparisons (cont.)