Remember we discussed this previously.

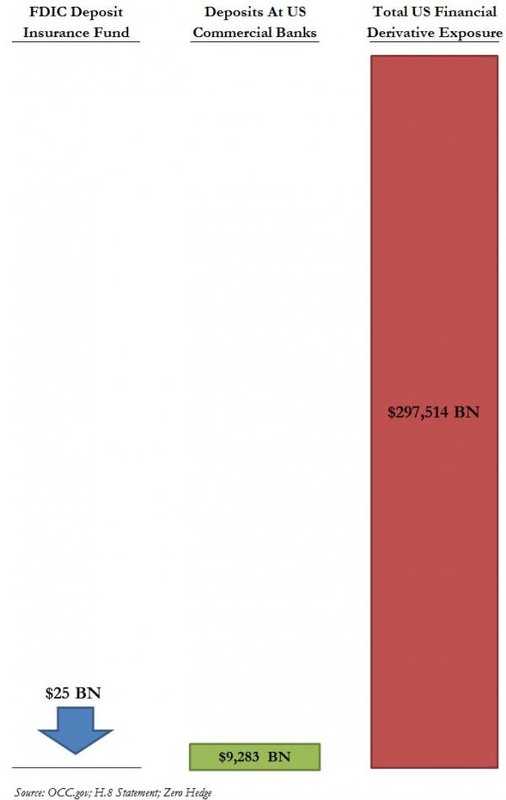

http://talk.newagtalk.com/forums/thread-view.asp?tid=377977 Also keep in mind the inadequate funds in the FDIC.

The quote below in green comes from this article. Red emphasis is mine. http://www.zerohedge.com/news/2015-02-18/why-zirpnirp-killing-fractional-reserve-banking-forcing-deposits-gold

"All Governments have silently built in the “bail in” template for when the roof comes down. Where is the accountability of the politicians and bankers? The US, UK, EU, and Canada have recently all built the new "bail in" template into their laws in order to avoid imposing risk on “taxpayers” (and politicians and bankers of course). All taxpayers have bank accounts and therefore the avoidance argument basically is only important to get the government officials and the bankers off the hook i.e. their accountability! Under the new "template" all lenders (including depositors) to the bank can be forced to "bail in" their respective banks. Most depositors naively assume that their deposits are 100% safe in their banks and trust them to safeguard their savings. And most account holders don’t know that by law, when you put your money into a bank account, your money becomes the property of the bank. Your title “downgrades” from owner of your money to creditor of your money with millions of other creditors. You become an unsecured creditor with a claim against the bank. In other words if the bank goes bankrupt you share at pari (equally at fault) with other similar creditor/deposit holders. Great deal for the bank and bankers, no!" Edit: Fix first link

|

Something to keep in mind (re: bank deposits)

Something to keep in mind (re: bank deposits)