Since 2016, Trump's EPA has granted 85 small-refinery waivers totaling 4.03 billion ethanol-equivalent gallons not blended with gasoline.

https://www.dtnpf.com/agriculture/web/ag/news/article/2019/08/21/reynolds-naig-call-wheeler-waived

The Law requires that any waived gallons be redistributed so that the Goals of the RFS are maintained.

Again,

The 4.03 Billion gallons waived must be made up.

The Trump administration is supposedly considering options to quell the uprising against this Illegal Waiers.

http://www.ethanolproducer.com/articles/16476/perdue-memo-shows-options-to-boost-ethanol-following-sre-outrage

Under the first action, the EPA would rescind seven or eight of the SREs approved Aug. 9 that went to “big” companies. Under another action outlined in the memo, the EPA would expeditiously take steps to allow E10 pumps to be approved for E15. Under a third action, the EPA would take necessary actions to encourage and facilitate flex-fuel vehicles (FFVs) that can use E85. This would include immediately publishing FFV F-Factor guidance for automakers, updating the “R-factor” used in CAFE compliance, and including alternative compliance credits based on the demonstrated use of alternative fuels in FFVs in the final CAFE rules for 2021-2026. Under a fourth action, EPA and USDA would work together to “’fix’ major problems” in the proposed Renewable Fuel Standard reset rule that the memo said are “negative toward biofuels and contrary to your stated support of the RFS.” The EPA delivered its proposed RFS reset rule to the White House Office of Management and Budget on May 20. It is still under review and has not been released publically. The memo also includes a fifth action that Perdue said has not been agreed upon by EPA and is the subject of further discussion between EPA and USDA. Under that action, the EPA would redistribute on a prospective basis a reasonable number of gallons associated with projected SREs, beginning with the final rule to set 2020 RFS standards. In the memo, Perdue also said he would like to explore with EPA and DOE programs that would assist with infrastructure build-out for E15. There is a debate about whether the Waivers have affected Demand. I contend that.. They do.

Demand is "Price" x "Quantity" and not just Quantity alone... Thus if Demand is stable but the Price is reduced.. then Demand has been reduced.

This can be seen here..

RIN Values AFFECT Ethanol pricing.. If "obligated" parties do not purchase and blend ethanol they can purchase RINs to fulfill requirements of the RFS..

As RIN Prices fall..Through the GRANTING OF SRE WAIVERS.. that option is more viable vs buying and blending the actual ethanol.

As shown above.. Minnesota sold MORE ETHANOL with higher RIN prices.. vs 2019..

Also.. so far.. E-15 has allowed more ethanol to be sold during the summer.. so EPA has granted concessions to both sides.

However, Market Action on FRIDAY (August 9 2019) shows that the RIN's Market IS TIED to WAIVERS..

RIN values drop 40% as US EPA announces 2018 Small Refinery Exemptionshttps://www.spglobal.com/platts/en/market-insights/latest-news/agriculture/080919-rin-values-drop-40-as-us-epa-announces-2018-small-refinery-exemptions

Houston — Conventional renewable fuel or D6 2019 Renewable Identification Numbers lost 40% of their value late Friday afternoon on reports the US Environmental Protection Agency was set to make an announcement on 2018 Small Refinery Exemptions, sources said before the details were made public at 5 pm CT.

The EPA reported that 31 SREs would be granted for 2018, with 6 petitions denied. D6 RINs began the day trading at 20 cents/RIN, were assessed at 19.75 cents/RIN at 1:30 pm CDT before falling and were heard trading as low at 12 cents/RIN. The last time S&P Global Platts assessed 2019 D6 RINs below 12 cents/RIN was March 20. SREs are given to refineries with a capacity of less than 75,000 b/d that demonstrate that compliance with the Renewable Fuels Standard causes "disproportionate economic hardship." One key issue is that the EPA has not reallocated the mandate volumes that the small refineries would have been required to meet back into the program, which therefore has the practical effect of reducing mandates and lowering biofuel demand.

Scott Irwin has written about this.. he says that below the 10% level.. SRE's show no correlation to demand destruction.

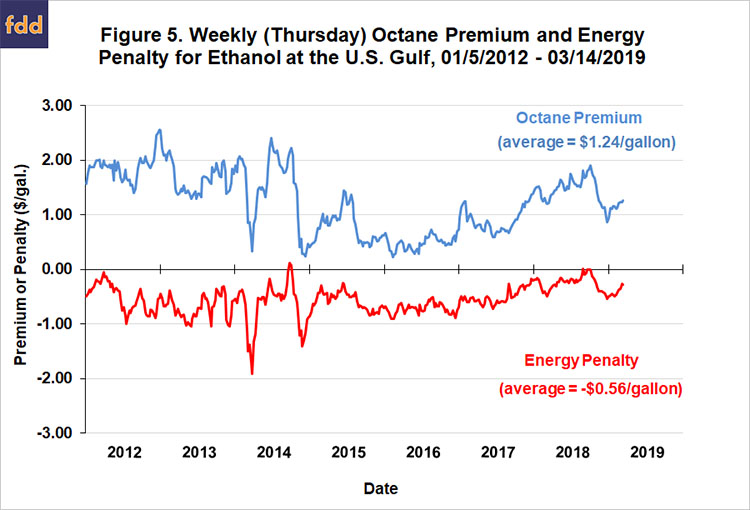

https://farmdocdaily.illinois.edu/2019/04/revisiting-the-value-of-ethanol-in-e10-gasoline-blends.html

Ethanol has value as an Octane additive which offsets it's Energy penalty.

For an overall Net Benefit

However in an earlier article Scott Irwin notes that Demand Destruction from the SRE's could be occurring above the 10% blend level.

https://farmdocdaily.illinois.edu/2019/01/small-refinery-exemptions-and-e85-demand-destruction.html

ImplicationsThe data now clearly show that small refinery exemptions (SREs) under the RFS have not reduced physical ethanol use in the form of E10 gasoline blends (farmdoc daily, September 13, 2018; December 13, 2018). However, the SREs have dramatically lowered D6 ethanol RIN prices and this should have reduced if not eliminated the incentive needed to encourage usage of higher ethanol blends such as E15 and E85. We examine the available data on E85 use in this article in order to see if trends in usage are consistent with this expectation. Surprisingly, each of the three series available in the public domain on E85 use show a consistent upward trend since December 2017, just the opposite of that predicted by the SRE-driven crash in D6 RIN prices. Furthermore, all three series show double-digit increases in E85 use during the December 2017 through October 2018 period. It appears that something other than RIN prices has been driving E85 use in recent months, and that something else appears to be growth in the number of gas stations offering E85 pumps. In all likelihood, this growth can be traced to the USDA Blender Infrastructure Program that was announced in late 2015. Finally, it is important to recognize that the public data on E85 use in the U.S. is incomplete and this should be considered when viewing the results presented in this article. Anyway, the Market has been Affected by the Illegal Waivers and the Goals of the RFS have not been met.

Edited by JonSCKs 8/25/2019 20:46

|

My solution for the Illegal Rin Waivers. Part 1 History.

My solution for the Illegal Rin Waivers. Part 1 History.