The Future of Monetary Policy / Classic Doctrines Overturned

Everyone is hanging on will-she or won't-she raise rates by 25 basis points.

I think this focus misses the more interesting questions for current monetary policy. The last 10 years or so are a remarkable experience, a Michelson-Morley1 moment, which overturn long-held monetary policy doctrines. The plan to raise rates via interest on reserves in a large balance sheet completely changes the basic mechanism by which monetary policy is said to affect the economy.

Facts

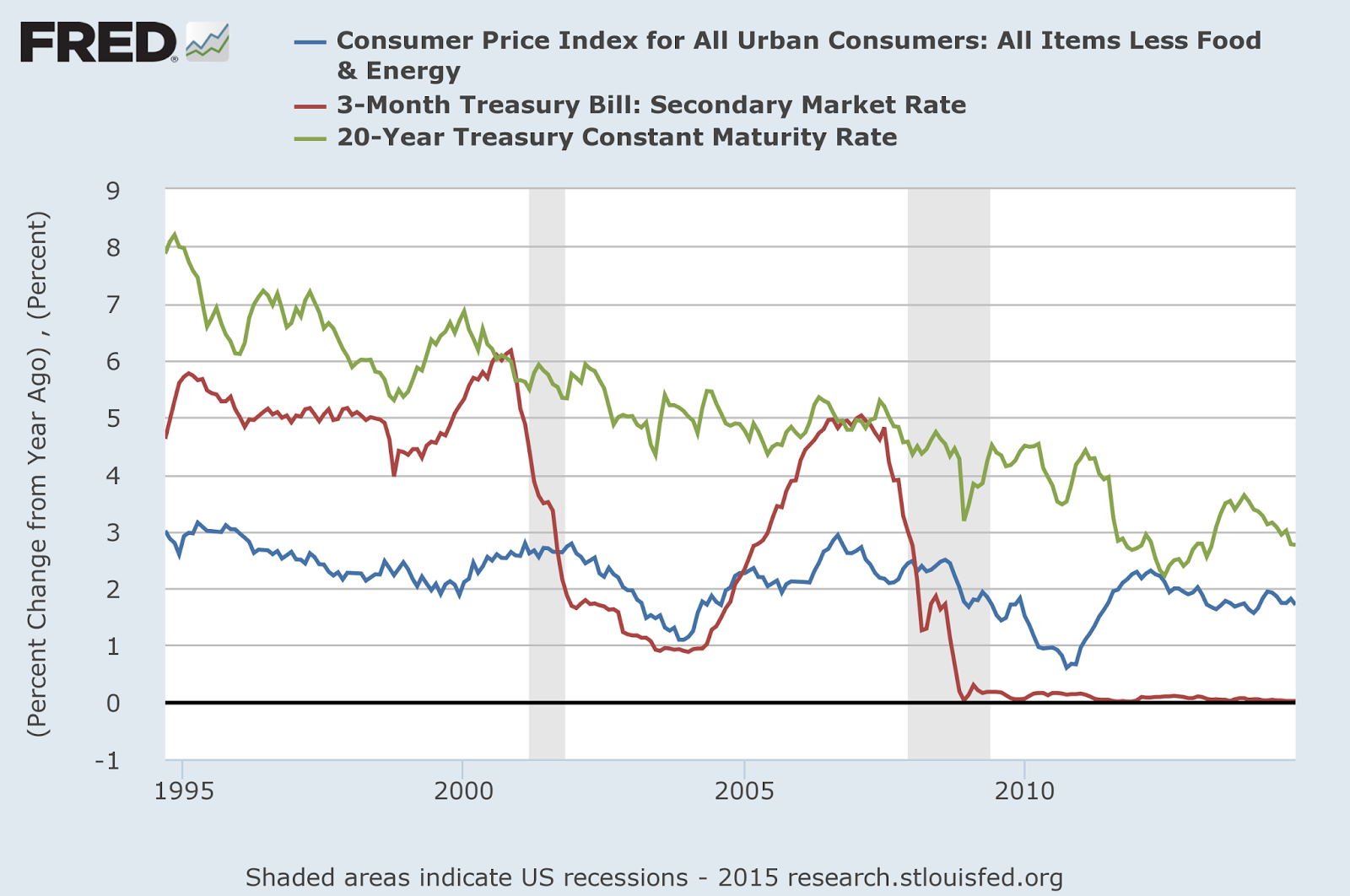

Controlling inflation is the first main task of monetary policy. Inflation, in the blue line below, has been slowly and inexorably declining over the last two decades, from 3% in 1995 down to a bit under 2% now. Inflation declines just after recessions and rises again as the economy recovers.

Long term interest rates, in green, are a good measure of long-term inflation expectations. Long-term rates basically follow a linear downward trend, barely interrupted by economic events or short term interest rate movements. When Fed officials say "expectations are anchored" or "trending down" this is one of their main indicators. If you, like me, believe in low inflation, it's awfully hard to complain too loudly about the Fed!

Short-term interest rates, in red, fall reliably in recessions, stay at zero while output and employment remain low, and then rise as the economy recovers.

However, the short rate hit the "zero bound" in 2008 and has been stuck there ever since.

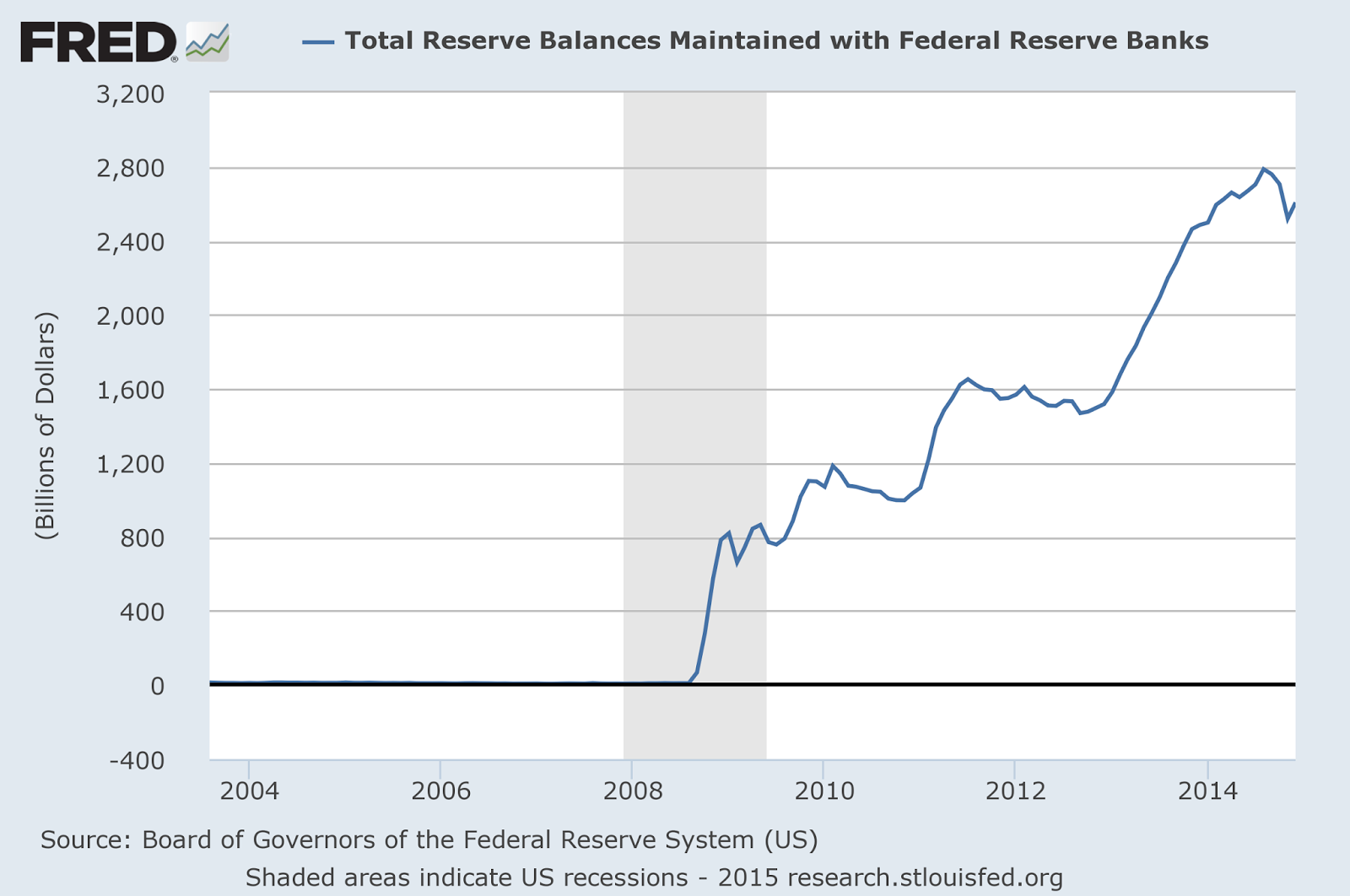

When rates hit zero, the Fed started buying assets and issuing bank reserves in return. In this action, the Fed is pretty much just acting as a huge money market fund that invests in Treasuries. You can see the big upward jump in the recession, and then the QE2 and QE3 episodes.

Reserves were a few tens of billions before 2007. Their expansion is thus really breathtaking.

These are our Michelson-Morley observations. We hit the zero bound and... nothing happened. We expanded money -- reserves -- from tens of billions to nearly 3 trillion and... nothing happened.

Doctrines Overturned

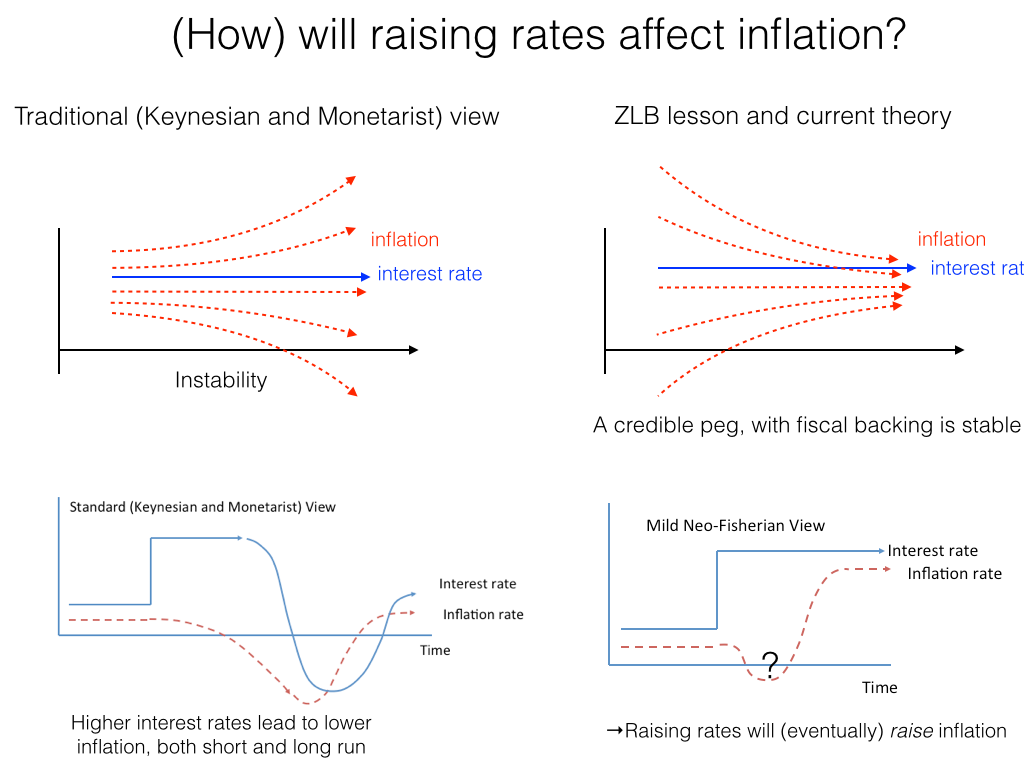

The traditional view of monetary policy, including both "Monetarists" and "Keynesians," (bad labels, but they'll have to do for now) agrees on some core doctrines:

- The economy is unstable. If the Fed pegs the interest rate at a fixed value, either expanding inflation or spiraling deflation will follow.

- Raising interest rates lowers inflation. Lowering interest rates raises inflation.

The top left pictures illustrate the instability proposition. Peg interest rates, and inflation or deflation will explode. On the bottom left, I graph how rising interest rates are thought to lower inflation, and answer why we don't see the unstable inflation or deflation of the top graph: Because, if inflation breaks out, the Fed really raises rates fast and bring it back down. Or vice versa as I have graphed it.

But if the Fed can't lower interest rates past zero, the unstable deflation breaks out.

It's like balancing an umbrella in the palm of your hand. If you hold your hand still, the umbrella tips over. If you want to move the umbrella to the left, move your hand to the right. But then move it fast to the left to keep it from tipping over. If your hand gets stuck, the umbrella will crash to the floor.

The last 10 years deeply challenge this view. Interest rates got stuck at zero. No spiral broke out. Inflation just calmly came down to join the interest rates. The economy is stable, as graphed in the top right.

That means that if the Fed raises interest rates and sticks them at a higher level, bottom right, inflation will eventually rise to meet it as well, as graphed in the bottom right.

Our experiment exactly overturns the classic doctrines:

- An interest rate peg, if credible and expected to last for a long time, and if people trust the government to pay its debts, is stable.

- In the long run, raising interest rates to a new peg must raise inflation (and vice versa).

Hyperinflation? Or, as this article says . . . ??

Hyperinflation? Or, as this article says . . . ??