| Here is what I can not get around.. How do you offset this?

( http://peakoilbarrel.com/wp-content/uploads/2014/02/AAA-Ovi1.png )

You can see this in the North Dakota report (https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf )

Eleven years ago the Average North Dakota well produced 9 bbls per day.. NINE!! Granted there were less than 200 wells producing.. Four years later we got that up to 146.. by quadrupling the number of wells.. They've been able to hold it north of 120 per well per day by Drill baby drilling.. however, now that we've laid down the rigs.. it's going to fall below 100 pretty quickly.. unless the price goes back above the breakeven level.

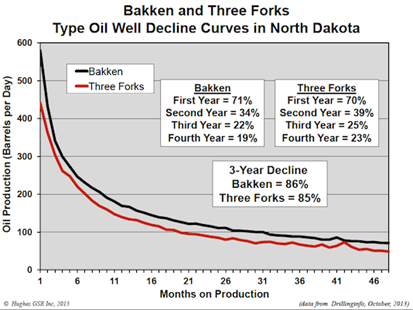

Every well is different.. in the sweet spot you may be starting from a higher initial production level.. and costs are coming down but golly this is hard to ignore..

This study assess the breakeven levels for Bakken Shale production.. ( http://digitalcommons.mtu.edu/cgi/viewcontent.cgi?article=1868&... ) In their analysis they use $153 Crude in the out years.. and guess what? That works.. 26% IRR

However the breakeven analysis comes in around (page 87) $63.26 per bbl.. I assume at the wellhead.. which is something we are NO WHERE near right now..

No doubt it's probably cheaper to drill now.. but couple the high decline rates with the crash in Crude prices.. that is a very strong headwind to overcome.. Given that leases can run $3 k per acre.. no doubt they are trying to hold production.. but golly.. that's a lot of $$$

If a $3 k lease on 640 acres = $1.92 myn.. Real $$$

My title on the previous post is probably not accurate.. US production is a factor.. but wall street has over estimated (imho) our competitiveness.. Lease rates will undoubtedly fall.. drilling costs will come down.. our competitiveness will improve.. but you can only cut so much..

Shell is pushing ahead with Drilling in the artic.. given the deepwater horizon spill and the BILLIONS that has cost BP.. Imagine what a similar scenerio would cost in the Artic.. and yet Shell believes future conditions will warrent the costs.. That right there tells you that someone is optimistic on future Crude prices... We're gonna see $100 Crude again.. in my lifetime.. probably sooner than many expect..

jmho.. I could be wrong.

Given the unexpectedly low jobs number last week.. no doubt there have been layoffs in the energy sector of the US.. As crude prices rise.. we'll go back to work.. and US production will stabilize.. right now.. we're living off the results of the drilling boom.. "only a matter of time."

Edited by JonSCKs 9/6/2015 23:18

|

Not If.. but When..

Not If.. but When..