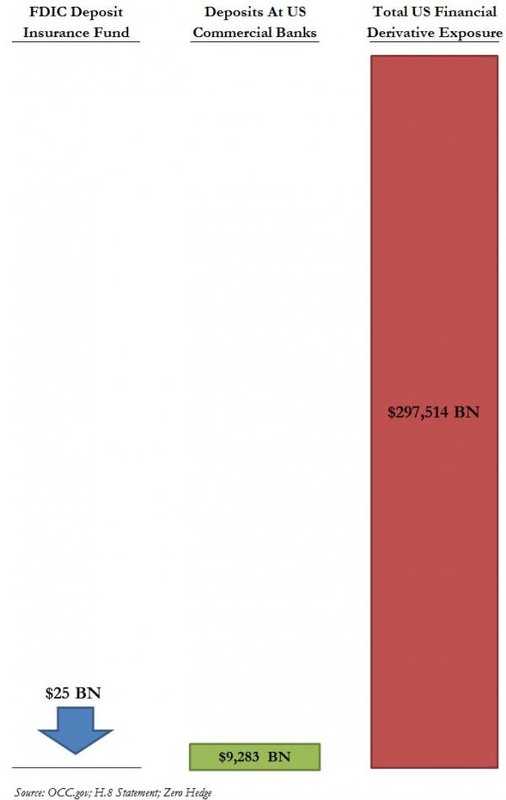

This graph is from a few years ago so it's probably even worse now if the real results were known.

Not even close to covering actual deposits but now tack on the derivatives they want to saddle the taxpayer with and it becomes obvious they intend to steal and plunder anything they can via a bail in when the timing is right. Now some will say the FDIC has an implicit guarantee from Treasury to back depositors but what will a US dollar be worth if they have to print enough to cover just the bank deposits let alone the derivative exposure ? The derivatives monster must be de fanged by marking things to market nightly on an open exchange for all to see. Here is the one dollar of Capital plan that mentions this. http://market-ticker.org/akcs-www?singlepost=2996132 |

Remember Cyprus and the bail ins ?

Remember Cyprus and the bail ins ?