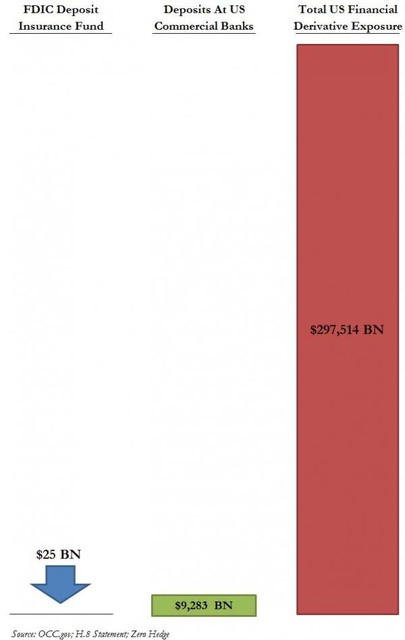

Okay Iowegian you posted down below you were a banker. 1) What sort of enlightenment can you share on the confiscation of assets that is going on in Cyprus ? Set aside the issue of who is getting confiscated. For the most part(large Russian accounts that may or may not be clean in their origins). The fact remains that depositors who are supposed to be the last class to be liquidated were moved up the line and found themselves suborned by bondholders who were supposed to be first in line for losses but are now found to be part of the protected classes not getting crammed down. In this country, FDIC is supposed to step in and resolve any insolvencies before there is any chance that customers will take the loss. However I think you can see by this chart FDIC is not really in any situation to do this on a massive scale if a TBTF bank gets in trouble. A TBTF could find themselves in massive trouble if all the derivatives, swaps, and counter party agreements are questioned or turn against them. 2) Do you favor or oppose a return of Glass /Steagall and placing all financial derivatives on exchanges and having them marked nightly to market ?

From this link the following in blue text below describing how the FDIC and capital system is supposed to be set up in the USA. "Because those arms of government put forward a capital structure that looked like this, as we did here in the United States:

Depositors

======== <<< Government regulatory oversight barrier

Senior Bondholders

Unsecured Bondholders

Equity (stock) holders

And then they formalized that structure with a published and formal guarantee that deposits were safe. The claim was predicated on the right to monitor an institution to guarantee that it could always "cram down" the subordinated levels in the capital structure, one at a time, and that the government would step in and close the institution before any deficit reached the top Depositor level."

The EU community was supposed to have a similar protective structure in place also correct ?

So what are you telling depositors when they ask this question

3) Will you comply if directed by the Federal Reserve or Govt. to seize assets out of deposit holders accounts ? 4) What personally are you willing to do to prevent this from happening in the USA or at your bank ? This would be in cases other than withholding levies assessed by the IRS for current legitimate taxation purposes. That, however, opens a sticky gray area in my mind because technically anything could be assessed as a tax if the PTB wanted to truly steal our money they could also electronically zero out account holders despite your voicing opposition as head of a bank. The outright theft via Bernanke's money printing and QE programs are far worse than what happened in Cyprus as they are ongoing and not a 1 time levy against an account. I've asked this question at my credit union and got these replies earlier. "This is far from the case in the US where banking laws are much, much tighter and hence the prospects of banking accounts being taxed are zero."

"This is way different in the United States. Banks are not insolvent here and the banking laws are too tough to allow anything like this to happen" Today's follow up reply came after sending the link to this policy paper as well as some other interesting links on financial matters. I also found it interesting over the weekend several times this "magical" 25% number floated up perhaps now even in Spain or other EU countries. In my opinion, policy papers are a way to propose actions that later seem to always move forward and nobody can ever quite pin point where the idea originated from. Invariable it always seems to go back to these proposals that are written by people who always manage to profit form the proposals they write. Today's reply from the credit union contained this. Redacted in parenthesis is the name of the credit union. I can assure you that the Senior Leadership Team and Board of Directors realize the key issue of trust that our members place in us for the safe keeping of their hard earned money. We are aware of no law or legal authority that would allow government at any level (local, state, federal) to confiscate funds belonging to members which are deposited at (redacted) Credit Union, except when the Internal Revenue Service orders (redacted) to withhold taxes from dividends paid to members on their accounts (similar to withholding of taxes from paychecks). 5) So do we trust banks and bankers to stand tall against confiscation and theft, and that they will deny access and seizure of our accounts and balances ? I'm not specifically calling you out as a banker but as a representative of that industry discussing things here. I am anxious to hear your reply. I realize that lots of these issues seem to stem from the larger TBTF banks and are not usually indicative of actions of small community banks and credit unions. I think everyone that has ever struggled to earn and save a dollar is fed up with what they see going on. Will you support the rule of law and demand that those making the mess take their losses ? or will you allow the sacred trust of depositors to be broken ? I don't think I need to remind everyone that a trust broken takes a very very long time to rebuild and sometimes can never be re-established. For everyone else here are you asking these questions of your contacts in your financial institutions ? If not why ? Again Iowegian, I mean no disrespect to you personally and I'm not meaning to call you out on this issue if your not in a position to answer this publicly. However, from our conversations on Market Talk as of late, I think everyone is very nervous, and unsure of what is the correct move for them and is skeptical of what is really going on behind the scenes that we are not being told about. Their confidence and trust is perhaps being shaken and re-assurances of "that cannot happen here" are not adequately addressing their concerns. In my opinion only, this is the time for financial sector people of integrity like many found in small community banks and credit unions to step forward and answer these difficult questions.

They in return, need to start questioning their boards of directors and regulators and demand that the rule of law be upheld equally for everyone and ask that honesty and integrity be returned to all financial institutions and to put the soundness and good of the country and system above greed and personal enrichment. My opinions only, but I feel lots of people here want some straight answers that so far they are not getting.

Again I mean no disrespect to you personally and hope this can be an honest and positive conversation for Market talk participants. We have all had many great discussions here in the last few weeks and your input is very much appreciated.

How do we build trust and understanding for depositors and bankers. |

For Iowegian and others Re: Banker conversations.

For Iowegian and others Re: Banker conversations.