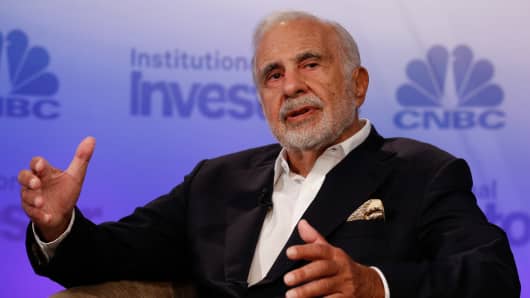

- Shares of CVR Energy have more than doubled since August, resulting in a $1.4 billion paper gain for Carl Icahn, who holds an 82-percent stake in the company.

- CVR Energy's stock price slumped through much of last year as it became clear EPA would not adopt a policy proposal put forward by Icahn that would benefit the the company.

- However, CVR Energy and its peers in the refining sector have since benefited from EPA's willingness to grant financial hardship waivers to small refineries.

Published 12:10 PM ET Fri, 4 May 2018

Farmers get the SHAFT.. while Icahn gets the Gold.

Furthermore, the Trump administration asks OPEC to Increase output to provide CHEAPER Crude so Refiners margins will be enhanced..??

( https://www.bloomberg.com/news/articles/2018-06-05/u-s-said-to-ask-opec-for-1-million-barrel-a-day-oil-output-hike )

The U.S. government has quietly asked Saudi Arabia and some other OPEC producers to increase oil production by about 1 million barrels a day, according to people familiar with the matter.

The rare request came after U.S. retail gasoline prices surged to their highest in more than three years and President Donald Trump publicly complained about OPEC policy and rising oil prices on Twitter. It also follows Washington’s decision to reimpose sanctions on Iran’s crude exports that had previously displaced about 1 million barrels a day, or just over 1 percent of global production.

If the Trump administration wanted to do something to lower gasoline Costs for Consumers.. why not allow HIGHER BLENDS of ethanol which is almost $0.70 CHEAPER than RBOB right now..

Which ALSO will put more RINs in the MARKETPLACE hence lowering their costs by MARKET actions..???

E-15 law violation

E-15 law violation