East Central South Dakota | Then on the ground today........We have had some excellent posts, to make us think outside of today and into the brightness of the future. Here is my weak attempt to add to the conversation. Start thinking strategically to last generationally------this is just a year out of hopefully 5 generations + +

1. Since the implementation of the CRP program in 1985 we have lost roughly 43 million acres to urban sprawl. This is roughly equivalent to the farmable acres in the state of Nebraska. Our current pace is 1.5 million acres a year lost to asphalt and concrete. A lot of these acres are by cities where rivers meet, some of the best farm land that exists on the planet---------market volatility.

2. We have expanded west to gain some of these acres back. Technology and recent good weather has tempered the switch, but without a doubt we are trading low production risk land for higher production risk land. Stocks/use are comfortable, but clearly not burdensome. We have to maintain production with land that has a higher production risk----market volatility.

3. World population expansion is occurring in the countries that have some of the least increase in food production. World governmental and economic instability is increasing------market volatility.

4. Expansion of the CRP program is gaining a lot of bipartisan support in this down turn. Acres that are being accepted are coming from the corn belt not the states out west. Again we are trading low production risk land for high production risk land. Can we really afford to expand CRP with these carryout numbers ( ten year contracts ) ? ? Farm policy can shift acres-----market volatility.

5. Will the above temper the severity of the correction ? ? Can demand curb the crash of the traditional 30 year agricultural cycle ? ? or at least shorten the crash segment.

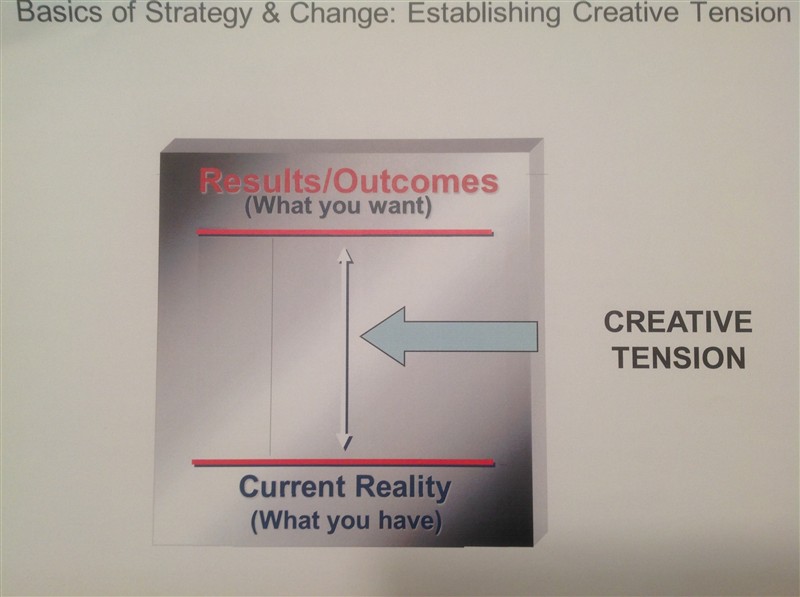

6. I guess I am not that troubled yet----- corrections bring opportunities for those that can think in terms of 5 years out instead of today. If your farm hasn't done a strategic plan maybe today is the right time to start. Use your creative tension to think outside of the box to adjust your survivability in today's market place.

7. Markets trade off of human behavior and emotions and that has us down today and tomorrow. The above listings don't have the power to adjust the human behavior of the 30 year cycle today-----it doesn't however change some of the challenges listed above. This market with a poor crop in one of the hemispheres could have a "oh crap" moment in a hurry. Buckle up and live through today for tomorrow shows some of the promises of volatility------I am just going to sell more of it this time.

Edited by white shadow 8/28/2016 21:31

(image.jpeg) (image.jpeg)

(image.jpeg) (image.jpeg)

(image.jpeg) (image.jpeg)

Attachments

----------------

image.jpeg (83KB - 272 downloads) image.jpeg (83KB - 272 downloads)

image.jpeg (108KB - 279 downloads) image.jpeg (108KB - 279 downloads)

image.jpeg (62KB - 282 downloads) image.jpeg (62KB - 282 downloads)

|

Easier to be positive at 40,000 feet ............

Easier to be positive at 40,000 feet ............