|

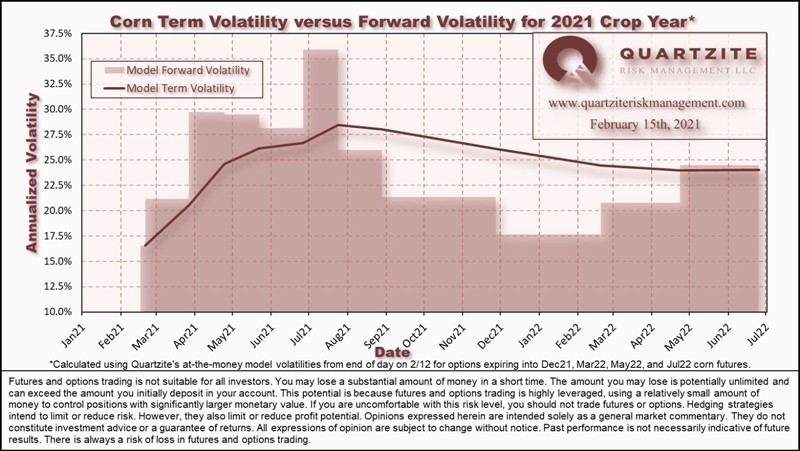

Fort Collins, CO | I posted a version of this chart in response to a question that popped up on this week's Weekly Corn Market Update thread. I cleaned it up a bit and wanted to post it here in the main forum because I thought it might start a good conversation. It is a chart calculated using the at-the-money volatilities we are running (as of Friday's close) for different listed options expirations on the 2021 corn crop (in this case, short-dated March 2021-September 2021, December 2021, March 2022, and Jul 2022). It shows the difference between term and forward volatilities.

Term volatility is the volatility expected between now and any future point A or B (in this case some listed option expiration). Forward volatility is the volatility expected between points A and B that justifies them having different term volatilities. We can calculate term volatility between any two expirations, but in this chart, we are only showing the consecutive term volatilities from one expiration to the next.

You might ask, so what? That's a fair question. What this information can show us is the relative value of one expiration versus another. This is one piece of information we might use to indicate which expirations we should be focused on buying or selling. Of course, just because a given expiration shows a high or low term volatility does not make it an automatic buy or sell.

Take the short-dated August expiration, for example. It shows the highest term volatility of any expiration on the chart, but that might be justified because it covers the June monthly, June quarterly, and July monthly USDA releases, as well as the extremely important weather period from late June to mid-July. The short-dated July expiration, on the other hand, only gets the June monthly WASDE from the USDA. So, who is to say if one is relatively more or less expensive than the other.

Of course, it should go without saying that this is presented for your information only. It is not in any way a recommendation to trade anything. Just a tool you might use if your marketing/risk management strategy includes options.

Let me know your thoughts.

Thanks,

James

(20210215 Forward vs. Term (full).jpg) (20210215 Forward vs. Term (full).jpg)

Attachments

----------------

20210215 Forward vs. Term (full).jpg (111KB - 51 downloads) 20210215 Forward vs. Term (full).jpg (111KB - 51 downloads)

| |

|

Term versus Forward Volatility

Term versus Forward Volatility