|

E ND | Didn't the rule recently change that made a clear line where "maintenance" and "capital improvements" was distinguished? Either $$ limit or percent of value and needing to be treated one way or the other? Your listed activities seem like maintenance items to expense unless it was large-scale conversion of one type of property to another.

Not sure how you'd account for it if done yourself vs. being hired out but I know a full set of tires on an articulated tractor, engine overhaul, etc. is considered a capital improvement.

Quick google search: (No idea if this is current/correct or verified source)

General Principle of Capitalization:

The IRS indicates what constitutes a real property capital improvement as follows:

Fixing a defect or design flaw

Creating an addition, physical enlargement or expansion

Creating an increase in capacity, productivity or efficiency

Rebuilding property after the end of its economic useful life

Replacing a major component or structural part of the property

Adapting property to a new or different use

The proposed regulations require capitalization of amounts paid to acquire, produce, or improve tangible real and personal property, including amounts paid to facilitate (closing costs) the acquisition of tangible property. Amounts paid to repair and main property and equipment are deductable if those amounts are not required to be capitalized under §1.263(a)-3, which states in part that any amounts paid for permanent improvements or betterments made to increase the value of such property must be capitalized. Under the proposed regulations these improvement standards are applied to the building itself and individually to its structural components such as heating and ventilation, plumbing, electrical, fire protection and security systems and escalators and elevators. Also the new regulations will allow the dispositions of component parts of a building resulting in the recognition of a gain or loss upon the retirement of such component.

The proposed regulation also provides a "safe harbor" for routine maintenance. It indicates that recurring activities (inspection, cleaning, testing, replacing parts, and so on) that are expected to be performed as a result of the use of property to keep the property in its ordinarily operating condition aren't capital improvements. The activity is considered routine if, at the time the property was placed in service, the taxpayer reasonably expected to perform the activity more than once during the property's life.

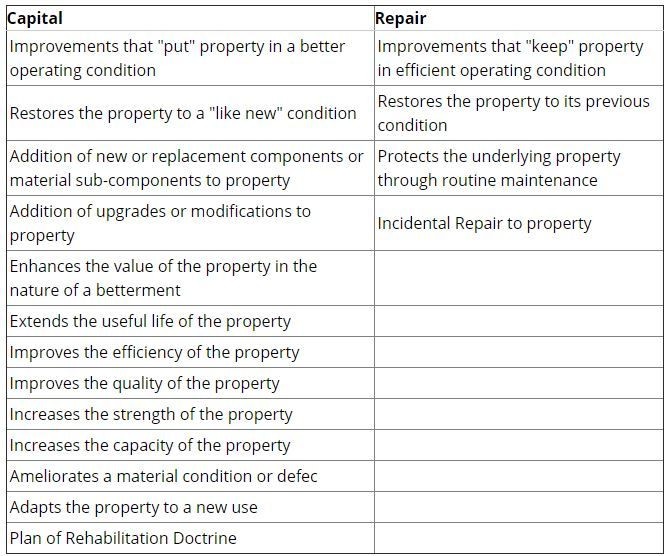

The following table summarizes many of the factual considerations used by the courts. These factors, although not exhaustive, should be considered in your analysis to distinguish between capital expenditures and deductible repairs.

Edited by NDCat99 12/29/2020 12:08

(2020-12-29 12_07_14-IRS Clarifies Capital Improvement vs Repair Expense_ _ Dermody, Burke & Brown (full).jpg) (2020-12-29 12_07_14-IRS Clarifies Capital Improvement vs Repair Expense_ _ Dermody, Burke & Brown (full).jpg)

Attachments

----------------

2020-12-29 12_07_14-IRS Clarifies Capital Improvement vs Repair Expense_ _ Dermody, Burke & Brown (full).jpg (107KB - 109 downloads) 2020-12-29 12_07_14-IRS Clarifies Capital Improvement vs Repair Expense_ _ Dermody, Burke & Brown (full).jpg (107KB - 109 downloads)

| |

|

Land improvements on balance sheet

Land improvements on balance sheet