|

| dko_scOH - 8/28/2020 11:02

Markets are a random walk. You cannot predict randomness...so you cannot predict markets. It's a lesson we all have to learn, eventually. Fortunately, I learned it in college, using a wall chart and no real money. Literally, the next quarter we got into efficient market theory...and the pieces fell into place.

Certainly, it can seem that way, but I can quite easily prove otherwise.

The first way I would do that is to show you a roll-adjusted chart of corn - condensed to monthly for an easy long term view. If the Efficient Market Theory was valid, a roll adjusted contract would be pretty much a straight level line. No markets behave like that, but corn is the poster child for disproving what you are saying.

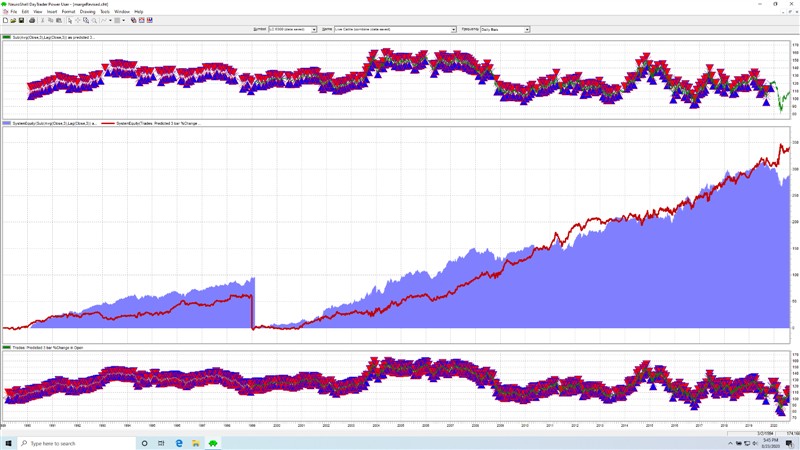

As for whether my favorite market is random or not, I'll attach a chart that might persuade most people otherwise. This market, like all others, is very complex. Markets are what is called chaotic - most definitely not random. There is order, although it tends to be very complex and difficult to predict. I would strongly suggest an older book now - James Gleick's CHAOS. Not always, however, but from time to time it certainly is.

But, you can take a look at the chart. I trained the AI algorithm back in Feb, 2005. As you can see, the data used to train the net was the first ten years - 1989 to 1999. I kept out six years of data as out-of-sample data to see how the net would trade in the equivalent of real time. I have never retrained this particular net, as I have always been curious about how it would perform in real time. Since the out-of-sample data set up to Feb, 2005, you can see how this model has behaved. This has been now going on 15 years. (Note: The red line in the middle window is the model in the bottom window. It looks good, but I did not bother to include the Vig (commission costs plus slippage), and it trades often enough that the profitability is significantly reduced when that is included. What the blue shaded area shows, however, is the system equity for the original model - almost 21 years in real time - and counting. (Note also: the right scale is in $/cwt, as it was an initial model I ran and I did not bother to convert it to dollars.)

If this market was random, and the Efficient Market Theory was valid, this would be impossible. Or at least, extremely unlikely - especially given the consistency shown.

But, again, most any futures market that is viewed as a roll adjusted contract will show the EMT to be incorrect. And not only the ag markets - the bond market clearly shows the same thing.

(Screen Shot 2020-08-23 at 5.45.51 PM (full).png) (Screen Shot 2020-08-23 at 5.45.51 PM (full).png)

Attachments

----------------

Screen Shot 2020-08-23 at 5.45.51 PM (full).png (98KB - 99 downloads) Screen Shot 2020-08-23 at 5.45.51 PM (full).png (98KB - 99 downloads)

| |

|

How a doctor learns to ignore some of his medical training

How a doctor learns to ignore some of his medical training